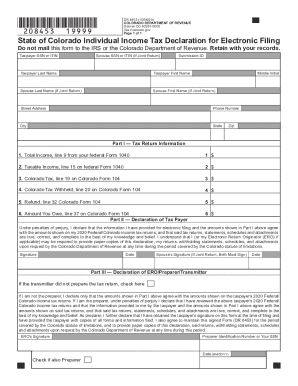

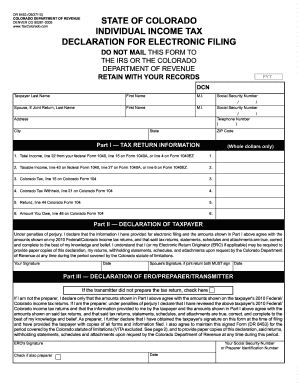

CO DR 8453 2021-2024 free printable template

Show details

*DONATED×DR 8453 (10/19/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO 802610005

Tax. Colorado.instructions

Line InstructionsSubmission ID

The 20digit number is assigned by the preparation

software

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your colorado dr 8453 2021-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado dr 8453 2021-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit colorado dr 8453 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit colorado 8453 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

CO DR 8453 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out colorado dr 8453 2021-2024

How to fill out Colorado DR 8453?

01

Sign in to the Colorado Department of Revenue's Revenue Online website.

02

Locate the DR 8453 form under the "Individual Income Tax Forms" section.

03

Download and print the DR 8453 form.

04

Fill out your name, address, and Social Security number in the designated spaces.

05

Review the instructions on the form to ensure that you understand the requirements for completing it.

06

Attach any required supporting documents or forms, such as W-2s or 1099s.

07

Complete the declaration statement on the form, confirming that the information provided is accurate and complete.

08

Sign and date the form.

09

Make a copy of the completed form for your records.

10

Mail the original completed form to the address specified on the form instructions.

Who needs Colorado DR 8453?

01

Individuals who are required to file a Colorado state income tax return.

02

Those who need to provide additional documentation or forms to support their income tax filing.

03

Anyone who is required to sign and submit a declaration statement to the Colorado Department of Revenue.

Fill colorado dr8453 : Try Risk Free

People Also Ask about colorado dr 8453

Who has to pay Colorado state income tax?

Is there a state tax form for Colorado?

Who is exempt from Colorado state tax?

Who is exempt from Colorado state income tax?

What is form 8454 Colorado?

Why do I need form 8453?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is colorado dr 8453?

Colorado DR 8453 is a form used by taxpayers in Colorado to authorize an electronic return originator (ERO) to send their state tax return to the Colorado Department of Revenue on their behalf. The form allows the ERO to e-file the taxpayer's return electronically. It is usually used by tax professionals or software providers who assist taxpayers in preparing and filing their tax returns.

Who is required to file colorado dr 8453?

Individuals who file Colorado income tax returns electronically are required to file Form DR 8453, Colorado Individual Income Tax Declaration for Electronic Filing.

How to fill out colorado dr 8453?

To fill out the Colorado DR 8453 form, please follow these steps:

1. Visit the Colorado Department of Revenue website (https://tax.colorado.gov) and search for form DR 8453.

2. Download the form DR 8453 and open it in a PDF reader or print a physical copy.

3. Read the instructions on the form carefully to understand the requirements and steps.

4. Fill out the taxpayer information section at the top of the form, including your name, social security number, address, and phone number.

5. Check the appropriate box to indicate the type of tax return you are filing (e.g., individual, corporation, partnership, etc.).

6. If you are filing jointly with your spouse, provide their information in the spouse section.

7. Enter your electronic filing PIN, if applicable.

8. If you are a paid preparer, provide your information in the preparer section.

9. Review the authorization checkboxes located at the bottom of the form, such as the taxpayer declaration, paid preparer declaration, and spouse declaration.

10. Sign and date the form in the designated spaces.

11. Attach any required supporting documents or schedules as instructed in the form's instructions.

12. Make a copy of the filled-out form and supporting documents for your records.

13. Submit the form, along with any necessary attachments or schedules, to the Colorado Department of Revenue according to their guidelines. This may involve mailing the documents or submitting them electronically, depending on your filing method.

It is advisable to consult with a tax professional or refer to the Colorado Department of Revenue's website for specific guidance or updates related to the DR 8453 form.

What is the purpose of colorado dr 8453?

The purpose of Colorado Form DR 8453 is to provide taxpayers with an official signature document and consent to electronically file their income tax return. This form is specifically used by taxpayers who are filing their state income tax return electronically but are unable to electronically sign their return. The Form DR 8453 allows the taxpayer to provide their consent and signature manually before submitting their electronic tax return.

What information must be reported on colorado dr 8453?

The Colorado DR 8453 form, also known as the Colorado Electronic Filer Registration and Authorization Form, requires the following information to be reported:

1. Taxpayer Information: The form requires the name, address, Social Security number or taxpayer identification number, contact information, and filing status of the taxpayer.

2. Representative Information: If the taxpayer is using a representative to electronically file their return, the representative's name, address, contact information, and Preparer Tax Identification Number (PTIN) must be provided.

3. Tax Year: The tax year for which the electronic filing is being authorized must be indicated.

4. Tax Return Information: The form asks for the type of tax return being filed (individual, corporate, partnership, fiduciary, etc.) and the specific form number (e.g., 1040, 1065, 1120, etc.).

5. Electronic Filing Information: The form requires the details of the electronic filing software or service being used to file the tax return, including the name of the software or service provider, the provider's Electronic Filing Identification Number (EFIN), and any associated software identification numbers.

6. Authorization and Signature: The taxpayer or their authorized representative must sign and date the form to authorize the electronic filing of their tax return.

It's important to note that the information required on the DR 8453 form may vary or change over time. Always refer to the latest version of the form and any accompanying instructions provided by the Colorado Department of Revenue for the most accurate and up-to-date reporting requirements.

What is the penalty for the late filing of colorado dr 8453?

According to the Colorado Department of Revenue, if you file your DR 8453 form (Colorado Individual Income Tax Declaration for Electronic Filing) late, you may be subject to penalties and interest. The specific penalty amount depends on the extent of the delay in filing and paying taxes owed. Generally, the penalty for late filing is 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum penalty of 25% of the unpaid tax. Additionally, interest is charged on any unpaid tax at a rate set by the department.

It's important to note that the penalty and interest rates may change over time, so it is recommended to refer to the official Colorado Department of Revenue website or consult with a tax professional for the most up-to-date information.

Where do I find colorado dr 8453?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the colorado 8453 form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in colorado 8453 tax form without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your colorado 8453, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I fill out dr 8453 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your dr8453 tax form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your colorado dr 8453 2021-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Colorado 8453 Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to dr 8453 tax form

Related to colorado dr 8453 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.